Have you ever considered that India’s cross-border tax compliance costs foreign companies an estimated $3.6 billion annually?

The Indian tax landscape presents unique challenges with its constantly evolving regulations, particularly in complex cross-border taxation matters that often require specialized Cross-Border Tax Advisory in India. Foreign businesses frequently struggle with understanding permanent establishment rules, withholding tax obligations, and extensive documentation requirements. Consequently, many companies face unexpected tax liabilities, penalties, and prolonged disputes with authorities.

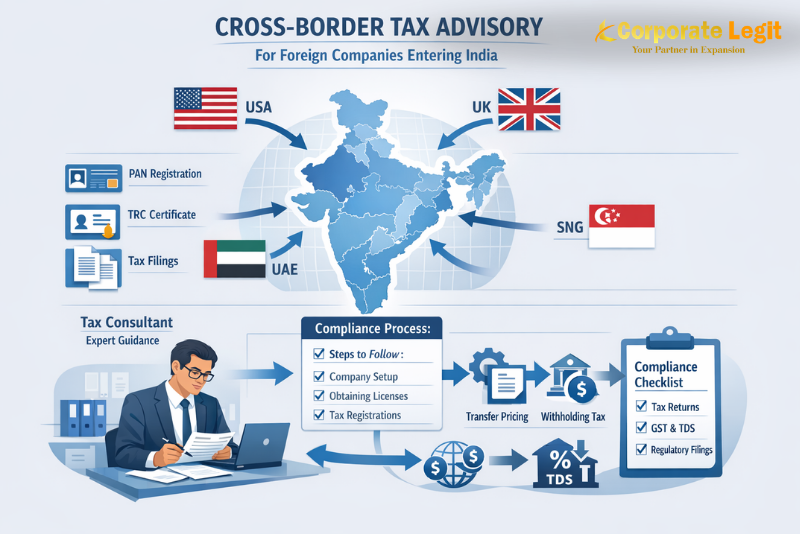

However, with proper planning and expert guidance through professional cross-border tax advisory in India, you can effectively manage your tax obligations while maximizing available benefits. This step-by-step guide specifically addresses the key aspects of Indian tax compliance that foreign companies must understand. From determining your tax exposure to handling transfer pricing documentation, we’ll walk you through the essential processes to ensure your business operates smoothly in the Indian market.

By following this practical approach, you’ll be equipped to make informed decisions, minimize risks, and focus on what truly matters—growing your business in one of the world’s most promising economies.

Step 1: Determine Your Tax Exposure in India

For foreign businesses, understanding your tax liability begins with identifying exactly where and how you generate revenue in India. The Indian tax system operates under a dual taxation regime, applying both source and residency-based taxation principles.

Identify income sources from India.

Initially, you must determine all revenue streams originating from India. Foreign companies typically generate income through:

- Sale of goods to Indian customers

- Licensing and royalties for technology or intellectual property

- Technical services, including consulting and IT support

- Income from financing through loans or other instruments

- Dividends from investments in Indian companies

Unlike resident entities that pay taxes on global income, non-resident companies are taxed exclusively on income sourced from India. For businesses seeking business advisory for foreign companies in India, understanding which transactions trigger taxation is essential, even digital transactions without physical presence can create tax obligations.

Understand the concept of Permanent Establishment (PE)

A Permanent Establishment refers to a fixed place of business through which your company conducts operations in India. This concept determines whether your business activities create a taxable presence.

The presence of a PE in India significantly impacts your tax liability – if established, your company becomes subject to Indian taxation on income attributable to that PE. Furthermore, PE can take various forms:

- Fixed place PE: Physical locations like offices, factories, or workshops

- Agency PE: When someone in India habitually exercises authority to conclude contracts on your behalf

- Service PE: When your employees provide services in India for a specific period

Furthermore, if your foreign company is deemed to have its Place of Effective Management (PoEM) in India, it could be classified as a resident for tax purposes, potentially subjecting global income to Indian taxation.

Evaluate business presence and risk of PE.

Assess your company’s activities thoroughly to identify potential PE risk factors. Even seemingly minor activities can inadvertently create a PE; for instance, a foreign consulting firm sending employees for short-term projects could establish a PE if activities continue for a substantial period.

Digital businesses face additional considerations through the Significant Economic Presence (SEP) provisions. These rules apply when:

- Revenue from Indian customers exceeds INR 20 million (approximately USD 275,000) in a financial year.

- You systematically engage with 300,000 or more Indian users.

Notably, DTAA benefits may shield you from SEP provisions, but companies from non-treaty countries face substantial tax exposure, with profits attributable to India potentially subject to tax at 40%.

Accurately determining your tax exposure is the critical first step in your cross-border tax advisory in India, forming the foundation for all subsequent compliance actions.

Step 2: Register and Prepare for Tax Filings

Once you’ve determined your tax exposure in India, securing proper registration becomes essential for legal compliance. Foreign companies must complete several critical documentation steps before conducting business operations.

Obtain a Permanent Account Number (PAN)

Obtaining a PAN is mandatory for foreign companies doing business in India and serves as your primary tax identification. To apply for PAN:

- Submit Form 49AA, specifically designed for foreign entities.

- Provide your company’s registration certificate issued in your home country.

- Ensure documents are properly attested through “Apostille” or by the Indian embassy/consulate.

- Pay the application fee (₹1,017 for physical PAN card delivery outside India)

The PAN becomes your universal identifier for all tax-related activities and is necessary for filing returns and claiming treaty benefits.

Register on the Indian Income Tax Portal

After securing your PAN, registration on the Income Tax Portal enables electronic filing and management of tax obligations:

- Visit the e-filing portal and select the “Register” option.

- Enter your newly obtained PAN and validate it.

- Provide required details, including contact information and address.

- Create a secure password following the portal’s security guidelines.

For foreign principal contacts without PAN, the Income Tax Department now offers a special registration process through efilinghelpdesk@incometaxindia.gov.in.

Understand the role of Form 10F and TRC.

Tax Residency Certificate (TRC) and Form 10F are crucial for claiming Double Taxation Avoidance Agreement (DTAA) benefits:

- TRC: Obtain from tax authorities in your home country to confirm residency status

- Form 10F: Self-declaration supplementing TRC with additional information

Importantly, electronic filing of Form 10F has become mandatory for claiming treaty benefits. Non-compliance can result in higher withholding tax rates on payments received from India.

From 2023, non-residents without PAN can register directly on the portal by providing basic company details, key person information, and supporting documentation.

Step 3: Handle Withholding Tax and DTAA Benefits

Withholding tax management represents a critical area where foreign companies can achieve substantial savings through proper planning and documentation. Indian tax authorities impose withholding tax at maximum rates of 20-30% plus applicable surcharge and cess on payments to non-residents.

Know applicable withholding tax rates.

Standard withholding tax rates for non-residents vary by income type. For non-resident companies, India applies 20% on royalties and fees for technical services, 20% on dividend income, and 5% on certain types of interest. Indeed, the Finance Act 2023 recently doubled the withholding tax rate on royalties and technical services from 10% to 20%, highlighting why professional cross-border tax advisory in India is essential to maximize DTAA benefits.

Use DTAA to reduce tax burden.

India maintains Double Taxation Avoidance Agreements with over 90 countries, offering significantly lower tax rates. For example:

- USA: 15% for dividends, 10-15% for interest and royalties

- UK: 15% for dividends, 10-15% for interest and royalties

- Singapore: 15% for dividends

These treaties allow for tax relief through three methods: deduction, exemption, or tax credit. Essentially, you can claim taxes paid in India as a credit against your home country’s tax liability.

Submit TRC and Form 10F to claim treaty benefits.

To access DTAA benefits, you must obtain a Tax Residency Certificate from your home country’s tax authority. Moreover, the electronic submission of Form 10F became mandatory in April 2023. This self-declaration provides details, including your tax identification number, residence status, and address.

Avoid higher TDS by timely documentation.

Without proper documentation, payors must deduct tax at higher rates, 20% or more. Therefore, timing is crucial; submit documentation before executing transactions to ensure the certificate is ready when payment occurs. For companies seeking cross-border tax advisory in India, this approach prevents funds from being unnecessarily tied up with tax authorities, streamlines compliance, and aligns with DTAA provisions for smoother repatriation of funds abroad.

Step 4: Comply with Transfer Pricing and Reporting

Transfer pricing remains a cornerstone of cross-border tax compliance for multinational enterprises operating in India, often requiring the expertise of transfer pricing consultants in India to ensure accuracy and regulatory alignment. Section 92 of the Income Tax Act mandates that transactions between associated enterprises must be conducted at “arm’s length” prices.

Maintain arm’s length pricing for intercompany transactions.

The arm’s length principle ensures that prices charged between related entities match what would be charged between independent parties. Indian regulations recognize six methods for determining arm’s length pricing:

- Comparable Uncontrolled Price method

- Resale Price method

- Cost Plus method

- Profit Split method

- Transactional Net Margin method

- Other method

Prepare Master File and Local File

In accordance with BEPS Action 13, India requires a three-tiered documentation approach:

Local File: Required when international transactions exceed ₹10 million (₹200 million for domestic transactions).

Master File: Mandatory when international transactions exceed ₹500 million (₹100 million for intangible-related transactions), and the group’s consolidated turnover exceeds ₹5 billion. Filing deadline: November 30 annually.

File Form 3CEB and Transfer Pricing Audit Report

All entities with international transactions must file Form 3CEB, certified by an independent chartered accountant, by October 31. This comprehensive form details all transactions with associated enterprises and the methods used to determine arm’s length pricing.

Understand CBC reporting if applicable.

Country-by-Country Reporting applies when consolidated group revenue exceeds ₹64 billion. This must be filed within 12 months from the end of the reporting accounting year. Penalties for non-compliance include daily fines of ₹5,000-₹50,000.

Conclusion

First and foremost, determining your tax exposure accurately prevents unexpected liabilities. Understanding permanent establishment rules protects your company from unintended tax consequences, while properly identifying income sources ensures appropriate tax treatment. This is where effective cross-border tax advisory in India can provide invaluable guidance.

Additionally, timely registration and proper documentation serve as crucial safeguards against compliance issues. Your PAN becomes the gateway to all tax-related activities in India, while Form 10F and TRC documentation unlock valuable treaty benefits that significantly reduce tax burdens.

Withholding tax management represents perhaps the most immediate opportunity for tax savings. DTAA benefits can reduce applicable rates substantially, though these advantages remain available only with proper documentation submitted at the right time.

Last but certainly not least, transfer pricing compliance demands particular attention due to its complexity and potential for significant penalties. Arm’s length pricing, together with proper documentation through Master Files, Local Files, and Form 3CEB, safeguards your company from transfer pricing adjustments and disputes. Expert cross-border tax advisory in India, as provided by Corporate Legit, ensures these measures are correctly implemented to minimize risk.

FAQs: Frequently Asked Questions

1. What is cross-border tax advisory in India?

Answer: Cross-border tax advisory in India involves professional guidance for foreign companies to comply with Indian tax laws, including permanent establishment rules, withholding tax, DTAA benefits, and transfer pricing regulations. It helps minimize liabilities and optimize tax efficiency.

2. How do foreign companies determine their tax exposure in India?

Answer: Foreign companies must identify all revenue streams sourced from India, such as sales, royalties, technical services, financing income, and dividends. Assessing potential Permanent Establishment (PE) and Significant Economic Presence (SEP) is critical for calculating tax obligations accurately.

3. What is the role of DTAA in reducing tax for non-residents?

Answer: India has Double Taxation Avoidance Agreements (DTAA) with over 90 countries. DTAA allows foreign companies to claim tax relief through deduction, exemption, or credit for taxes paid in India, thereby preventing double taxation and reducing withholding tax rates.

4. Why is transfer pricing compliance important in India?

Answer: Transfer pricing ensures that transactions between related entities follow the “arm’s length” principle. Proper documentation, including Master Files, Local Files, and Form 3CEB, safeguards companies from penalties, audits, and tax disputes under Section 92 of the Income Tax Act.

5. What documentation is required for foreign companies to claim tax benefits in India?

Answer: Key documents include a Permanent Account Number (PAN), Tax Residency Certificate (TRC), Form 10F, and timely filing of transfer pricing reports. Correct and timely submission ensures eligibility for DTAA benefits and prevents higher withholding tax deductions.