As businesses grow, financial complexity increases. Strategic oversight becomes necessary, but many companies cannot immediately support the cost of a full-time CFO. Virtual CFO Services fill this requirement by...

Foreign businesses expanding into India sometimes opt for a branch office setup in India to secure operational presence without forming a separate incorporated entity. In this setup, the branch...

Many international founders search for an LLC Setup in India, expecting the same structure available in other countries. India, however, does not offer a traditional Limited Liability Company. Instead,...

Expanding into India has become a deliberate strategic decision for many global businesses, not simply an optional step. The country’s expanding economy, evolving investment policies, and established regulatory environment...

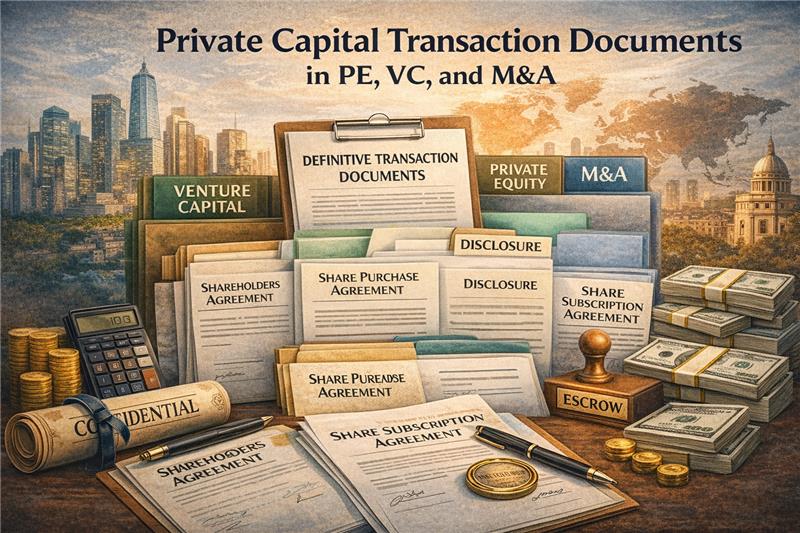

Private capital no longer moves on trust alone. It moves on paper. Every private capital transaction, whether structured as venture capital transactions, private equity transactions, or a Mergers and...

The Ultimate India FDI (Foreign Direct Investment) Consulting Checklist: Avoid These Common Mistakes

India became the world’s top FDI destination in 2015, surpassing China and the United States. That year, the country attracted $31 billion in foreign investments, while China and the...

Intellectual property rights form the backbone of modern innovation and business protection in today’s interconnected economy. As an international business law firm in India, we understand that these rights...

DTAA compliance in India is a major challenge for businesses that operate across borders. When companies earn income in more than one country, the risk of paying tax twice...

Successful market entry through business expansion services in India needs careful review and selection. Many companies feel overwhelmed by the number of service providers in this ever-changing market. The...

Legal battles through corporate legal services in India might drag on for years. Most cases find resolution before they even reach a courtroom. Business operations in India demand a...