Are you aware why India ranks among the top 5 most attractive manufacturing destinations globally? The process for manufacturing company setup in India offers tremendous opportunities, yet it navigates...

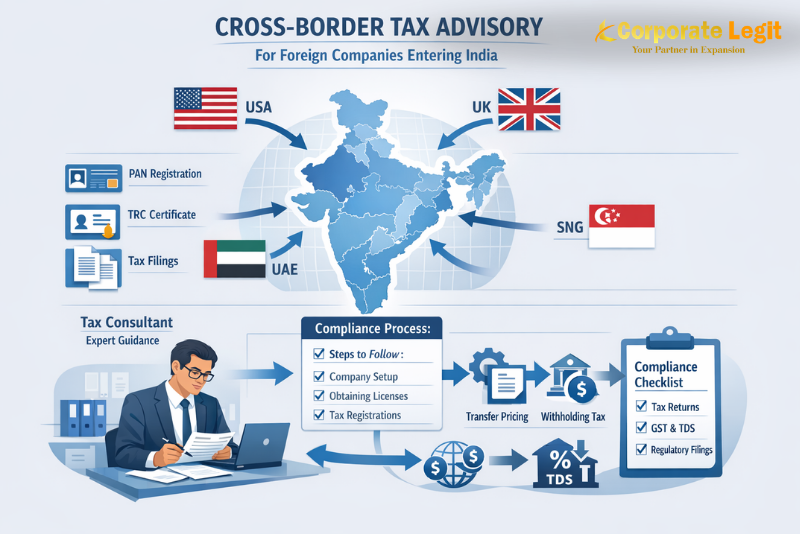

Have you ever considered that India’s cross-border tax compliance costs foreign companies an estimated $3.6 billion annually? The Indian tax landscape presents unique challenges with its constantly evolving regulations,...

Multinational corporations face the most important compliance challenges from India’s transfer pricing regulations, making professional transfer pricing services critical for effective compliance. The Finance Act of 2001 introduced these...

Did you know that establishing a wholly owned subsidiary setup in India allows foreign companies to retain complete control over their Indian operations while limiting liability to the invested...

Did you know that transfer pricing services have become a critical focus for tax authorities worldwide, with penalties for non-compliance often exceeding millions of dollars? For multinational enterprises, navigating...

Mergers and acquisitions consultant in India services have become crucial as the country’s M&A activity reaches unprecedented levels, with deals worth $82 billion recorded in the first half of...

Trademark registration is a critical legal step for businesses, start-ups, and individuals to safeguard their brand identity and gain exclusive rights over their unique mark. A trademark can include...

Did you know that professional tax registration in India is mandatory for employers in most states, with penalties reaching up to ₹5,000 for non-compliance? For businesses operating across multiple...

End-to-End India Entry Services reduce business setup time by a remarkable 60%, transforming what was once a months-long process into a streamlined operation. Setting up a business in India...

A Private Limited Company in India, including a wholly owned subsidiary in India of a foreign entity, is required to comply with multiple statutory, tax, and regulatory obligations throughout...